Kolkata Property Circle Rate Hike 2025: What It Means for Buyers and Investors

For the first time in seven years, the West Bengal government has revised the property circle rates in Kolkata. From September 17, 2025, the revised rates—ranging from a 15% to 90% increase depending on locality—have come into effect. This change will have a direct impact on stamp duty, registration fees, and overall property costs for homebuyers.

What Exactly Is a Circle Rate?

The circle rate is the minimum price at which a property has to be registered, as fixed by the government. Even if a buyer and seller agree on a lower price, the registration is done based on the circle rate. For buyers, this matters because stamp duty and registration fees are calculated on the circle rate, not on the deal value. If the circle rate ends up being higher than the market price, it creates additional tax and cost burdens for both parties.

Key Highlights of the Hike

- The revision ranges from 15% to as much as 90% in certain areas.

- Stamp duty continues to be 6% for properties below ?1 crore and 7% for those above ?1 crore.

- Due to the hike, most 3BHK flats and some 2BHK units in Kolkata now cross the ?1 crore threshold, pushing buyers into the higher stamp duty slab.

Locality-Wise Changes

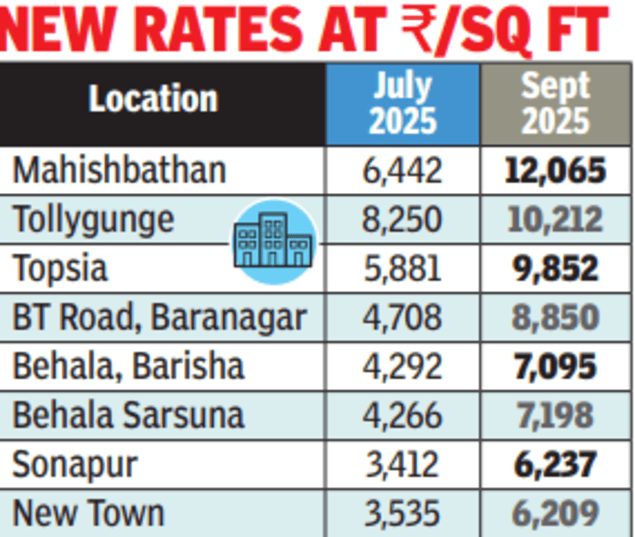

Some of the steepest hikes have been seen in areas that were already popular with homebuyers:

- Mahishbathan (Salt Lake fringe): up 87% to ?12,065/sq ft

- BT Road, Baranagar: almost doubled from ?4,708 to ?8,850/sq ft

- Tollygunge: revised to ?10,212/sq ft

These jumps mean buyers in these localities will face much higher upfront costs while registering their homes.

What It Means for Buyers

For most homebuyers, the immediate effect is higher registration and stamp duty costs. For instance, a flat that was earlier valued at ?95 lakh for registration may now cross ?1 crore after the circle rate revision, which increases the duty from 6% to 7%. In cases where the circle rate has gone beyond the prevailing market price, buyers and sellers may also face income tax liabilities on the difference. This makes property transactions more complex and costlier.

What Developers Are Saying

The response from developers and industry bodies has been cautious:

- Credai West Bengal agrees with the need to align circle rates with market prices but warns that overshooting could hurt demand.

- Merlin Group believes mismatched rates could make transactions harder to close.

- NK Realtors predicts a short-term dip in registrations as buyers and sellers adjust.

On a more optimistic note, Knight Frank India points out that demand in Kolkata has been strong. Registrations rose 37% between January and August 2025, even after earlier rebates were withdrawn.

The Bigger Picture

The Kolkata property circle rate hike 2025 is a balancing act. On one hand, it brings government rates closer to actual market values, plugging revenue losses. On the other, it risks creating distortions in areas where the circle rate has surpassed the selling price.That said, Kolkata’s housing market has remained resilient. Buyers still look at affordability, The primary motivators are long-term value and the assurance of house ownership. While there may be some slowdown in the short run, the city’s real estate market is expected to absorb this change over time.

Kalra Realty’s Perspectiv

At Kalra Realty, we understand that policy changes like the circle rate hike can create confusion and uncertainty. For purchasers, the difficulty lies not just in paying a little extra but also in understanding how these changes may affect affordability over time.

- Our role is to guide clients through this transition by:

- Helping them choose localities where circle rates and market prices remain in sync

- Giving a clear picture of stamp duty and registration charges before they commit

- Identifying projects that still offer good value despite the revised benchmarks

If you’re planning to buy property in Kolkata, the circle rate hike of 2025 should not discourage you. With the right advice and a transparent approach, homebuyers can still find opportunities that fit their budget.

? Reach out to Kalra Realty today to explore projects and make informed decisions in Kolkata’s evolving market.